Need To File A Hurricane Damage Insurance Claim?

Dealing with hurricane damage to your home or business is time consuming and can be very stressful. Damages range from minor repairs such as a couple of missing roof shingles to total destruction.

The Public Loss Adjusters at Insurance Claims Solutions Services, Inc. are experienced in interpreting your insurance policy and applying that information to maximize total recovery.

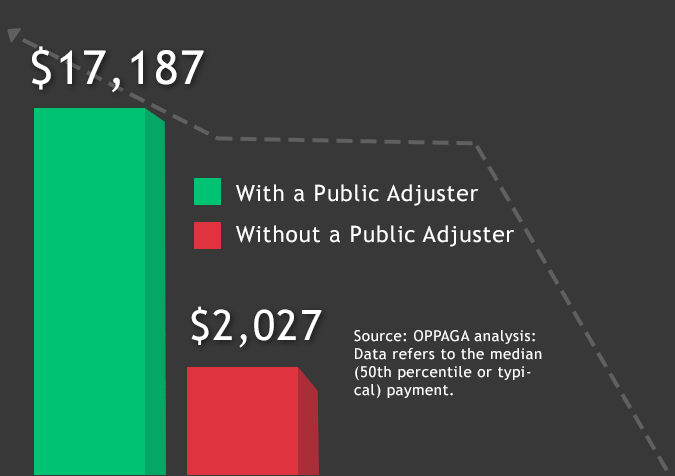

Statewide in Florida, policyholders that hired Public Adjusters for Hurricane Damage related insurance claims received 747% more money than those that did it on their own.

What Do I Need To Consider When Filing A Hurricane Damage Insurance Claim?

Typically a property insurance policy covers direct physical damage from a Hurricane or Windstorm. When direct physical damage is clear, such as entire or portions of the building’s roofs/walls have blown away or been damaged, then a coverage determination is relatively easy.

The major concern of the property owner then becomes, “What is the full amount needed for repair or replacement to make the building whole again?”

Business owners will suffer down time making the need to document business interruption losses. Homeowners will need to know where they will live while their home is being repaired. Not only is the building loss a concern, but business losses and personal property damage become a major portion of the Hurricane Damage Insurance Claim.

Should You Use A Public Adjuster For Your Hurricane Insurance Claim?

A Florida State licensed Public Insurance Adjuster represents you, the one making the claim for hurricane damage against the insurance company.

Florida Statutes provide for and regulate Public Adjusters to represent the insured, not the insurance company. You should use a Public Adjuster to have someone on your side that understands the full scope of the insurance contract and the claim process.

Check out Ten Reasons To Use A Public Adjuster and then Contact us for a FREE Claim Evaluation today!

Getting Started With Your Hurricane Insurance Claim

Your very first step should be to contact a Loss Adjuster at Insurance Claims Solutions Services, Inc.. The reason for this is to see if there are any immediate steps you need to take for your specific hurricane damage experience.

As always with any insurance claim, documentation of the event and damage caused by the event is very important. It may be necessary in some cases to begin the cleanup and repair process before you have a chance to meet with the insurance company’s adjuster. You should photograph and document the damage before any cleanup begins as the insurance company will want to see evidence of all damage. Not doing so could result in a reduced or denied insurance claim!

Insurance Claims Solutions Services, Inc. is here to assist you with making it through the ordeal of dealing with your Hurricane Damage Insurance Claim!

Underpaid or Denied?

Insurance companies want to save money by either offering the policyholder a fraction of the correct value of a claim or simply denying the claim.

We Can Re-Open Your Claim

Do you feel your previous insurance claim was underpaid or wrongly denied? You have 3 years from the original date of loss to reopen a claim.

We Work For You

If you have been wrongly denied or underpaid with a hurricane insurance claim, we can reopen your claim & get you a fairer, often larger settlement.