Need To File A Shower Leak Damage Insurance Claim?

Shower leak damage is a form of water damage that occurs when water gets behind the walls or under the pan. Shower leak damage is one of the hardest claims to collect from an insurance company. You should never try to go it on your own without professional help.

With this in mind, our first objective in preparing your insurance claim is to evaluate the scope of loss and damage as well as to analyze your insurance policy to see how it applies to your specific situation.

Have You Experienced Damage From A Shower Leak?

A leaking shower pan can cause expensive damage to your home’s bathroom and adjoining rooms. Most insurance policies exclude damage that is not sudden and happens over time. The language of this exclusion varies from policy to policy. Insurance Claims Solutions Services, Inc. will review the language of your policy and bring in the necessary experts to document the claim.

Our licensed Loss Adjusters are experienced in all aspects of shower leak damage insurance claims and can help guide you through this stressful situation.

Should You Use A Public Adjuster For Your Shower Leak Damage Insurance Claim?

A Florida State licensed Public Insurance Adjuster represents you, the one making the claim for your shower leak damage against the insurance company.

Florida Statutes provide for and regulate Public Adjusters to represent the insured, not the insurance company. You should use a Public Adjuster to have someone on your side that understands the full scope of the insurance contract and the claim process.

Check out Ten Reasons To Use A Public Adjuster and then Contact us for a FREE Claim Evaluation today!

Getting Started With Your Shower Leak Damage Insurance Claim

Your very first step should be to contact a Loss Adjuster at Insurance Claims Solutions Services, Inc.. The reason for this is to see if there are any immediate steps you need to take for your shower leak damage experience.

As always with any insurance claim, documentation of the event and damage caused by the event is very important. It may be necessary in some cases to begin the cleanup and repair process before you have a chance to meet with the insurance company’s adjuster. You should photograph and document the damage before any cleanup begins as the insurance company will want to see evidence of all damage. Not doing so could result in a reduced or denied insurance claim!

Insurance Claims Solutions Services, Inc. is here to assist you with making it through the ordeal of dealing with your Shower Leak Damage Insurance Claim!

Underpaid or Denied?

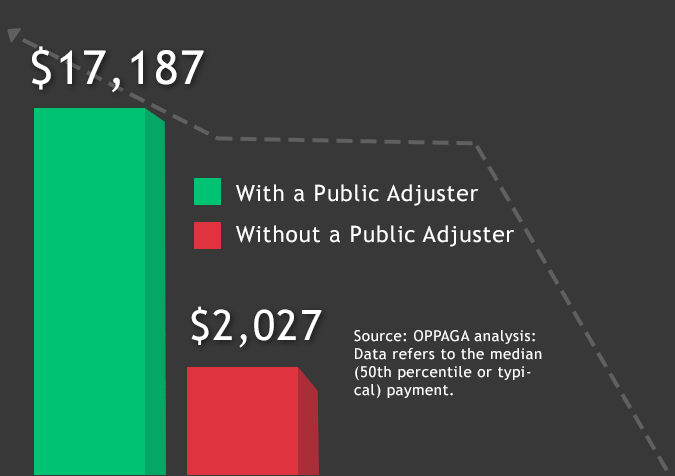

Insurance companies want to save money by either offering the policyholder a fraction of the correct value of a claim or simply denying the claim.

We Can Re-Open Your Claim

Do you feel your previous insurance claim was underpaid or wrongly denied? You have 3 years from the original date of loss to reopen a claim.

We Work For You

If you have been wrongly denied or underpaid with a hurricane insurance claim, we can reopen your claim & get you a fairer, often larger settlement.